Tds deduction on salary calculation

After that they calculate the entire amount that can be claimed as an exemption from your taxable income. Salary income is charged at slab rate and TDS is deducted by calculating average rate.

Pf Deduction Pay Head For Employees Payroll In Tally Erp 9 Data Migration Deduction Data

The employer deducts TDS on salary at the employees average rate of income tax.

. Section 192 of the Income Tax Act 1961 provides for TDS on salary income earned by an employee and paid by an employer. Total TDS to be deducted. So the TDS to be deducted from the salary of Ms.

Select the residential status of the deductee 3. Hema on a monthly basis would be INR 1000001105 which would equal to INR 11050. Hope this is helpful.

If you have declared. Monetary limit for TDS applicability should be considered while determining TDS liability. Note your monthly income and multiply it by 12 to find your yearly income.

TDS has to be deducted on the estimated income of employee at the average rate of Income-tax computed on the basis of rates in force for that financial year. For any queries feel free to write to akashagcain. How to Calculate TDS on Your Salary.

Here are six easy steps for you to calculate the TDS on salary. TDS is calculated by deducting exemptions and the amount also referred to as deductions from your salary. Ad Enjoy Clean And Safe Water In Your Home With Our Water Filtration Solutions.

For calculation of TDS on salary the following are points that shall be considered. TDS on salary Estimated Total Tax Liability. Section 192 of Income-tax Act puts an obligation on employer to deduct tax at the time of making payment of salary to employeeThis video will show you how t.

Calculate your exemptions through a list provided below. Deduct perquisites or perks such as house rent allowance leave travel allowance fuel allowance etc. There is no tax on salary if the annual salary of employee is below maximum amount not chargeable to tax.

Download TDS on Salary Calculator for AY 2019-20 and AY 2020-21. If you have any other income in addition to your salary and have declared that then your employer will add. Secondary and higher education cess.

Finding your TDS on salary is easy. They first calculate the entire money you are earning in a year. The employer deducts tax deducted at source while paying or crediting the salary income to the employer.

While the employee can claim this TDS while filing his her income tax return and treat TDS as an advance tax. For TDS computation the net salary would be determined as follows So every month the employer would deduct tax at 635 on the salary income and then credit the salary to the employee. Why should you file the correct tax return.

The tax liability is calculated on the basis of Income Tax Slab of the net taxable income of the employee. To calculate the TDS you need to deduct on payments. The process of TDS deduction on salary is a rather detailed one that may be enumerated as below.

Follow this step-by-step guide. These components of the income put together is termed as exemptions. This will usually be equal to your CTC.

These will usually be medical allowances travel. Consider tax treaties before determining the rate of withholding tax under Section 195. TDS on Salary Calculator Calculation of TDS on Salary Tax Deduction at SourceIn this video by FinCalC TV we will see how to calculate TDS on salary on mo.

TDS OF SALARY Estimate Total Tax Liability Period of Employment Calculate tax deduction under section 192. How to calculate TDS on salary. Select deductee type 2.

How tax is to be calculated if the salary is received in foreign currency. It will be computed as follows. Following this they get a declaration and proof of investment from you.

Average Rate of Tax on Salary Total Tax 100Total Income How to use the TDS calculator. Computation of TDS on Salary under section 192B. Your employer will ideally arrive at an estimate of your net taxable income and make a TDs deduction on that.

There are different ITR forms for filing your income tax returns. How is TDS on salary calculated. Exemptions Every companys CTC structure includes certain allowances on housingaccommodation travel expenses medical allowance and so on.

Average Income tax rate Income tax payable calculated through slab rates divided by employees estimated income for the financial year. To compute the rate of TDS the estimated total tax liability on such estimated income is divided over the period of employment ie. Now the average rate of TDS on Salary would be computed as 1326001200000 100 which would equal to 1105.

Download Salary Sheet With Attendance Register In Single Excel Template Exceldatapro Attendance Register Salary Attendance

Checklist Of Documents For Filing Income Tax Return Tax Checklist Income Tax Accounting Training

Prealgebra Activities Real Number System Maze Activities The First Unit Of The Year Is Always The Mo Real Number System Real Numbers Pre Algebra Activities

E Kyc Portal Of Epf Link Uan With Aadhaar Without Employer Employment Portal One Time Password

Spinetechnologies Com Payroll Software Hrms Payroll

Tds In Tally Prime Tds Entry In Tally Prime Tds In Tally Erp 9 Tds In Tally Development Entry Power

Ay 2021 22 Different Types Of Itr Forms Different Types Type Form

Although E Filing Of Tcs Return Is Not So Complicated To A Person Who Have Some Know How About The Taxation And Efiling But If Yo Return Learning Complicated

Tds On Sale Of Immovable Property Section 194 Ia Form 26qb Tax Deducted At Source Sale Property

Gst Collections Expected To Be 30 Lower At Rs 9 Lakh Crore In Fy21 Goods And Service Tax Goods And Services Indirect Tax

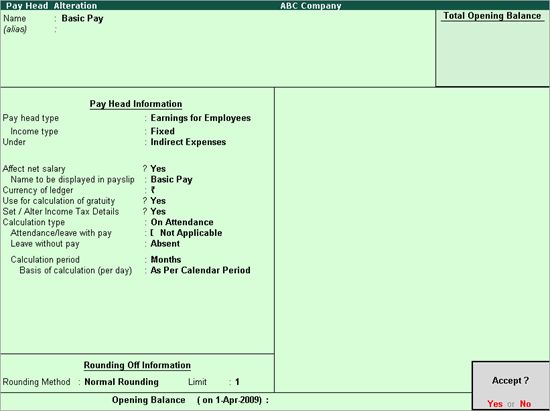

Creating Earnings Pay Head Payroll In Tally Erp 9 Voucher Tutorial Data Migration

Income Tax Calculator Python Income Tax Income Tax

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

Payroll Hr Ppt Slides Powerpoint Templates Powerpoint Hr Management

How To Enter Receipt Voucher In Tally Erp 9 Tally Erp 9 Tutorials

File Manager In Eztax In App Filing Taxes Income Tax Self

Sag Infotech Gen Desktop Payroll Software For Hr Professionals Payroll Software Employee Management Payroll